2021 Year End Legislative Summary

COVID-19

Emergency Periods

As of January 27, 2020 a Public Health Emergency (PHE) was declared by the Department of Health and Human Services (HHS). For the duration of the PHE, employer group health plans have enhanced coverage and limited cost share requirements under the FFCRA and the CARES Act. On March 13, 2020 a national emergency was declared by the President. Pursuant to this emergency, and IRS Notice 2021-1, employer health plans subject to ERISA and the IRC are still required to ‘disregard’ the emergency period when it comes to certain benefits related deadlines.

Through a series of renewals, both emergency declarations remain in effect as of the time of this writing.

Executive Order/ OSHA Rule

On September 9, President Biden issued an Executive Order directing the departments to promulgate a rule mandating employers with 100 or more employees to require vaccinations, or a weekly testing alternative, of all employees. On November 3rd, OSHA issued an Emergency Temporary Standard (ETS). As of the date of this writing, the OSHA ETS is on hold following the 5th Circuit’s decision, and pending further litigation.

THE AFFORDABLE CARE ACT (ACA)

Section 1557

The Affordable Care Act ‘prohibits discrimination on the basis of race, color, national origin, sex, age, or disability in certain health programs or activities’ via Section 1557. HHS released a new final rule 1557 in June 2020. The current version of the rule is narrower in scope than the 2016 rule, and defines discrimination ‘on the basis of sex’ to refer to gender assignment at birth. It also generally does not apply to employer health plans, as the rule defines ‘covered entity’ to mean “group health plans and employers that accept federal funding from the HHS or are principally engaged in the business of providing healthcare“.

On August 17, the US District Court for the Eastern District of New York blocked the HHS 1557 final rule, on the grounds that HHS acted in an arbitrary manner, and finding the rule goes against the Supreme Court’s 2020 decision in Bostock v Clayton. The Court’s ruling may be appealed so the current status of the 1557 final rule is now in limbo. There are several other cases challenging the constitutionality of the new rule 1557, which are currently pending.

The Employer Mandate

The penalties for noncompliance with the employer mandate will increase in 2022. Failure to offer coverage to ‘all’ full time employees under 4980H(a) will result in a penalty of $2,750 for each full time employee (minus 30). The penalty under 4980h(b) for failure to offer ‘affordable’ coverage, or coverage meeting the ACA’s minimum value criteria, will be $4,120 for each employee that receives a subsidy in the Marketplace. The affordability threshold will decrease from 9.83% in 2021, to 9.61% in 2022.

Carrier Updates

Brokers Compensation Disclosure

Section 202 of the 2020 Consolidated Appropriations Act amended ERISA’s prohibited transaction rule, requiring group health plans to have specific fee disclosures with any ‘covered service providers’ in order to take advantage of the long standing exemption to the prohibited transactions rules. A covered service provider is anyone that ‘reasonably expects’ to receive at least $1,000 in direct or indirect compensation for providing brokerage services or consulting under the contract made with the group health plan (or employer plan sponsor).

No Surprises Act

The 2020 Consolidated Appropriations Act (CAA) amended and expanded the Affordable Care Act’s patient protection provisions. Beginning in 2022, all health plans will include provisions to end surprise medical billing and surprise air ambulance bills, among other amendments.

Emergency Services Provided by a Nonparticipating Provider

If the plan covers emergency services, the plan must cover emergency services provided by an out of network (OON) provider or facility without requiring prior authorization, while applying in-network cost sharing. Neither the OON facility nor the OON provider can balance bill the individual. Additionally, any cost sharing payments made by the individual must apply to the in network deductible and out of pocket maximum.

Non-Emergency Services Provided by OON Providers at Participating Facilities

The plan must cover non-emergency services provided by an OON provider at an in-network facility, applying the plan’s in-network cost share procedures. The OON provider generally cannot balance bill the individual. The exception will be if the OON provider provides ‘notice’ about the intent to balance bill in advance of services, and the individual agrees to pay the balance bill. The ‘notice’ exception to the prohibition on balance billing does not apply if the provider is considered an ‘ancillary provider’ such as an anesthesiologist. It also does not apply if there is no participating provider available, or the services are considered ‘urgent’ in nature. The plan will then make a payment, or provide notice of denial within 30 days after the OON provider submits their bill. The plan and the OON provider will have 30 days to negotiate before requesting IDR.

Department Regulations and Guidance

DOL/EEOC

The EEOC has updated their guidance regarding employers options when it comes to COVID-19 vaccinations and workplace policy. Similar to current wellness program incentives, employers are generally permitted to incentivize employees to receive a vaccine. Employers should note that this will impact the 1095-C reporting and affordability calculations. Wellness program incentives unrelated to tobacco use that provide discounts to employees (such as a reduced premium contribution) are disregarded in assessing affordability. In contrast, incentives unrelated to tobacco use that impose surcharges (premium penalties) on employees, are taken into account in assessing affordability.

The updated EEOC questions and answers specifically states the following regarding mandatory employee vaccination policies:

“Under the ADA, Title VII, and other federal employment nondiscrimination laws, may an employer require all employees physically entering the workplace to be vaccinated against COVID-19? (Updated 10/13/21)

The federal EEO laws do not prevent an employer from requiring all employees physically entering the workplace to be fully vaccinated against COVID-19, subject to the reasonable accommodation provisions of Title VII and the ADA and other EEO considerations discussed below.

In some circumstances, Title VII and the ADA require an employer to provide reasonable accommodations for employees who, because of a disability or a sincerely held religious belief, practice, or observance, do not get vaccinated against COVID-19, unless providing an accommodation would pose an undue hardship on the operation of the employer’s business. The analysis for undue hardship depends on whether the accommodation is for a disability (including pregnancy-related conditions that constitute a disability) (see K.6) or for religion (see K.12).

As with any employment policy, employers that have a vaccination requirement may need to respond to allegations that the requirement has a disparate impact on—or disproportionately excludes—employees based on their race, color, religion, sex, or national origin under Title VII (or age under the Age Discrimination in Employment Act [40+])”

HHS/CMS

The HHS/CMS joint FAQs from October 2021 remind employers that “Under PHS Act section 2705, Employee Retirement Income Security Act (ERISA) section 702, Internal Revenue Code (Code) section 9802, and the Departments’ implementing regulations, plans and issuers are generally prohibited from discriminating against participants, beneficiaries, and enrollees in eligibility, premiums, or contributions based on a health factor.” The departments specifically state that “employer group health plans cannot deny benefits to customers who have not gotten the COVID-19 vaccine.”

But the departments also concede that a discounted premium contribution is permitted for employees receiving the vaccine, as long as “the premium discount complies with the final wellness program regulations. A premium discount that requires an individual to perform or complete an activity related to a health factor, in this case obtaining a COVID-19 vaccination, to obtain a reward would be considered a wellness program that must comply with the five criteria for activity-only wellness programs.”

Under present guidance, vaccination status is not generally considered an ADA prohibited disability inquiry, but could potentially be a ‘health factor’. Employers interested in tying health plan options, enrollment, or premiums to vaccination status should consult with counsel to design such a strategy in a compliant manner under the myriad of applicable laws.

IRS

Notice 2021-15

The IRS clarified several aspects of the 2020 year end bill, specifically informing employers of their option to allow a full rollover of all remaining 2020 FSA and DCA employee funds, or offering a full 12 month grace period for these accounts. The notice also extended the flexibility to optionally allow mid-year health plan and FSA election changes without requiring qualifying events. Any of these options requires a plan document update before the end of the 2021 plan year.

Notice 2021-31

The IRS clarified many aspects of the ARPA COBRA subsidy in notice 2021-31.The ARPA granted a 100% COBRA subsidy to employees that were newly involuntarily terminated, or had a reduction in hours, and those that had these types of benefit loss and were still in their COBRA period. The subsidy expired on September 30, 2021.

Notice 2021-58

Following EBSA 2020-1 and 2021-1, the IRS clarified the application of the 1 year deadline extension when it comes to COBRA elections, and COBRA premium payments. The notice confirms that:

“If an individual elected COBRA continuation coverage outside of the initial 60-day COBRA election time frame, that individual generally will have one year and 105 days after the date the COBRA notice was provided to make the initial COBRA premium payment. “

“If an individual elected COBRA continuation coverage within the initial 60-day COBRA election time frame, that individual will have one year and 45 days after the date of the COBRA election to make the initial COBRA premium payment. “

Proposed Regulation 26 CFR 1, 53, 54 & 301

The proposed regulations would make electronic reporting for the Forms 1094-C and 1095-C mandatory for all applicable large employers beginning with the 2021 reporting season. For returns filed in 2022, employers who file 100 or more W2 forms will need to file the 1095-C and 1094-C forms electronically. In years after 2022, the threshold is reduced from fewer than 100 to fewer than 10. As of the time of this writing , it is unclear if this rule will take effect for the 2020 filing due in March 2022.

Employers should note that the IRS has stated there would be no good faith relief for filing errors in 2022. They have also indicated that filing deadlines (1/31 for employee distribution; 2/28 for hard copy IRS filing; 3/31 for AIR filing) would NOT be extended this year as they have been in the past.

PCORI

The PCORI Fee was extended for an additional 10 years by the budget bill at the end of 2019. In July 2022, most non-calendar year plans will pay $2.66 per enrolled member for their 2019-2020 plan years. Calendar year plans, and those beginning 11/1 and 12/1, will pay an amount higher than $2.66 per covered life in 2022 (the indexed 2022 PCORI fee for calendar year plans is not yet published as of the time of this writing).

SCOTUS

In California et al v Texas et al, the court dismissed the case on procedural grounds, ducking a substantive finding regarding the constitutionality of the individual mandate, since the penalty itself has been reduced to $0.

State Guidance- Paid Family and Medical Leave 2022

New York Paid Family Leave

In 2022, NY PFL leave will remain at 12 weeks in duration, payable at 67% of the average weekly wage, for a maximum weekly benefit of $1,068.36. Employee contributions will be 0.511% to a wage cap of $82,917.64 (which is $423.71 for the year).

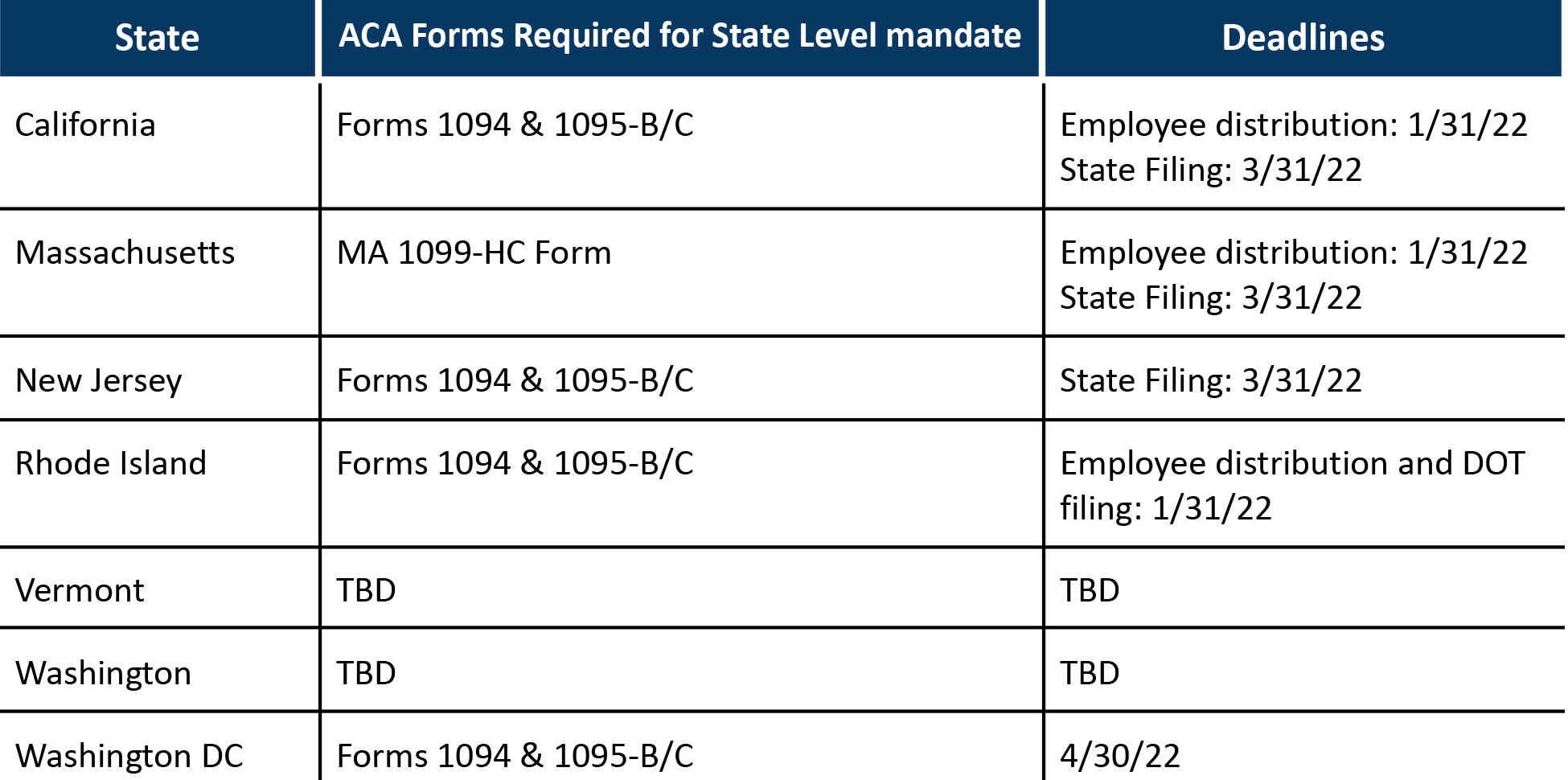

State Guidance- 2021 Individual Minimum Essential Coverage Mandates

Employers with any employees located in the below states need to ensure their payroll provider, or ACA filing vendor, is able (and contracted) to complete the employee distribution and/or state filings for the specific state individual mandates.